Diamond Report Series

Natural Diamond Trends:

A 2025 Overview

In 2025, natural diamonds continued to captivate consumers despite economic challenges. This report examines key shifts in demand, from larger stones and long fancy cuts to evolving jewellery styles and buying behaviours.

Published: February 9, 2026

Introduction

Consumers greatly value

the unique, timeless quality

of a natural diamond

Consumer demand for natural diamonds and jewellery proved remarkably resilient in 2025 despite the challenges facing the US jewellery sector from tariffs, inflation and the sharp rise in gold prices.1

An enduring preference for natural diamonds as meaningful gifts or personal pieces of luxury anchored consumer demand in 2025. Consumers continued to show appreciation for the authenticity, deep Earth origins and timeless versatility of natural diamonds that can be passed down through generations as treasured heirlooms.

Cultural moments across the year also kept natural diamonds firmly in the spotlight. Major celebrity engagements – including that of pop icon Taylor Swift – and a series of record-breaking auction results2 all contributed to what was described as “one of the most extraordinary years in jewellery history”. Holiday jewellery sales by speciality jewellers were up more than 6% to end the year on a high.

This is our second report on natural diamond trends. It looks at the key patterns that shaped US natural diamond demand in 2025 and what consumers are choosing in terms of cut, colour, clarity and carat weight (the 4Cs). We also explore trends in jewellery acquisitions and design. You can find more information on each of the 4Cs in the 2024 report3 or on the Natural Diamond Council website4.

The data on natural diamond jewellery in this report was provided by Tenoris5, who collated information from over four million jewellery transactions by 2,500 speciality jewellers across the US.

Standout Trends

Standout Trends of 2025

Growth in long fancy shapes and a continued shift to larger, higher quality diamonds.

+2.1%

Growth in natural diamond jewellery

sales by speciality jewellers.

10%

Strong growth in average price of

natural diamond jewellery.

+12%

Growth in marquise jewellery, reflecting

the shift towards long fancy shapes.

+9%

Growth in jewellery with centre stones

of 2.00–2.24 carats, on top of the

18% growth registered in 2024.

46%

Combined sales in Nov/Dec (30%) and

the celebration months of Valentine’s

(7%) and Mother’s Day (9%).

SI to VS

VS-clarity diamonds are continuing to rise in popularity.

Styling tips for natural diamond jewellery. Credit: Natural Diamond Council

Strong desire:

43% of women and 55% of men anticipate purchasing or receiving natural diamond jewellery in the next 2 years (Ipsos/De Beers 2025 survey on 18-74 year-old adults)

DESIGNER TRENDS

Wedding sets, tennis

bracelets and pendants

Strong growth in sales and average price.

Diamond tennis bracelets Credit: Natural Diamond Council

Looking Ahead

Consumers are gravitating toward jewellery pieces that feel playful, expressive and distinctive. The Pinterest Predicts 2026 report6 also highlights nostalgia and self- expression as key themes, driving interest in vintage and Art Deco pieces. Brooches and vintage pins are emerging as a hot trend, as is men’s jewellery.

Napoleon’s Diamond Brooch. Credit: Sotheby’s

Napoleon’s brooch, perfectly on trend two centuries later

French Emperor Napoleon adored diamonds – he wore them, cherished them and gifted them. When he fled the Battle of Waterloo in 1815, the Prussian army seized his carriage carrying the diamond brooch he wore on his iconic bicorn hat (and 133 loose diamonds). The brooch was given to the Prussian king and stayed in his family for generations. It eventually resurfaced at Sotheby’s Geneva in November 2025, where it sold for $4.4 million – more than 20 times its estimate.

Despite its age, the brooch is strikingly in tune with today’s tastes: a 13 carat oval centre framed by old mine cuts, aligning with the demand for elongated shapes, antique craftsmanship and heirloom grade value. It also mirrors the current resurgence of brooches, the rise of men’s diamond jewellery, and consumers’ appetite for pieces with a compelling backstory and value that holds across generations.

Diamond Cuts

Cut and Shape

Round cut diamond. Credit: Natural Diamond Council

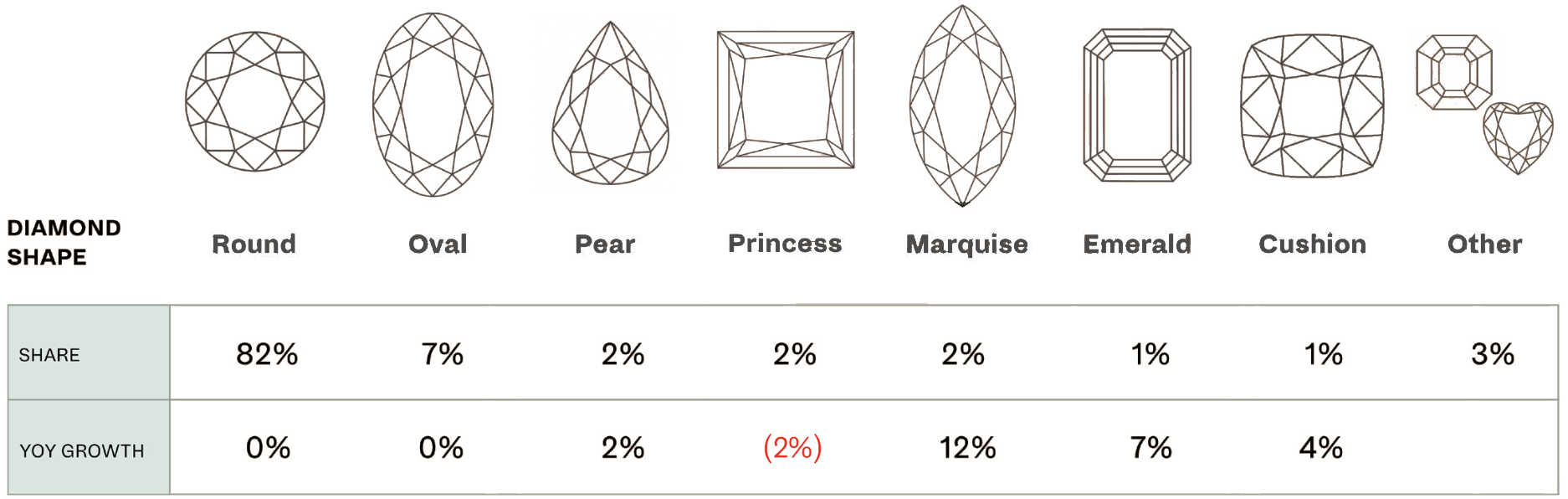

Round brilliants remained the sparklers of choice for US consumers, featuring in 82% of natural diamond jewellery pieces.

Their continued popularity is not surprising7 as the circle – the shape of the sun and the moon – has been a constant in jewellery since the earliest human history. The round brilliant is also the most sparkly and vibrant of all the diamond cuts – reflecting up to 93% of the light that enters it8. It means that when the diamond is tilted, you get a mesmerising display of red, blue, yellow or orange flashes. This diamond fire is caused by white light being dispersed into a rainbow of colours. Rounds’ versatility means they work well across many settings including solitaire, halo, pavé, bezel, tension and three stone9. No surprise then that round brilliant remained the leading cut across every jewellery category, from rings and earrings to neckwear and bracelets in 2025.

The year also saw strong growth in long fancy shapes, led by marquises and emerald cuts.

The elongated shape of marquise diamonds is flattering on the finger because they create a slimming effect that often makes them appear larger than their actual carat weight. Long associated with glamour, they have starred in some of the most stylish eras in jewellery history. Think of the opulent court of Louis XV and Madame (Marquise) de Pompadour, the sleek Art Deco designs of the Jazz Age and the bold retro revival of the 1960s–80s. Marquise engagement rings have graced the fingers of both Jacqueline Kennedy Onassis and Selena Gomez, who showed the world her natural diamond solitaire set in a yellow gold eternity band in 2025.

Marquise cut diamond. Credit: Natural Diamond Council

MOST POPULAR SHAPES IN DIAMOND JEWELLERY 2025

Selena Gomez and Benny Blanco. Credit: Getty Images. Inset: Selena Gomez’s engagement ring, a marquise-cut natural diamond solitaire on a yellow gold eternity band. Credit: instagram.com/selenagomez

Clarity

Clarity

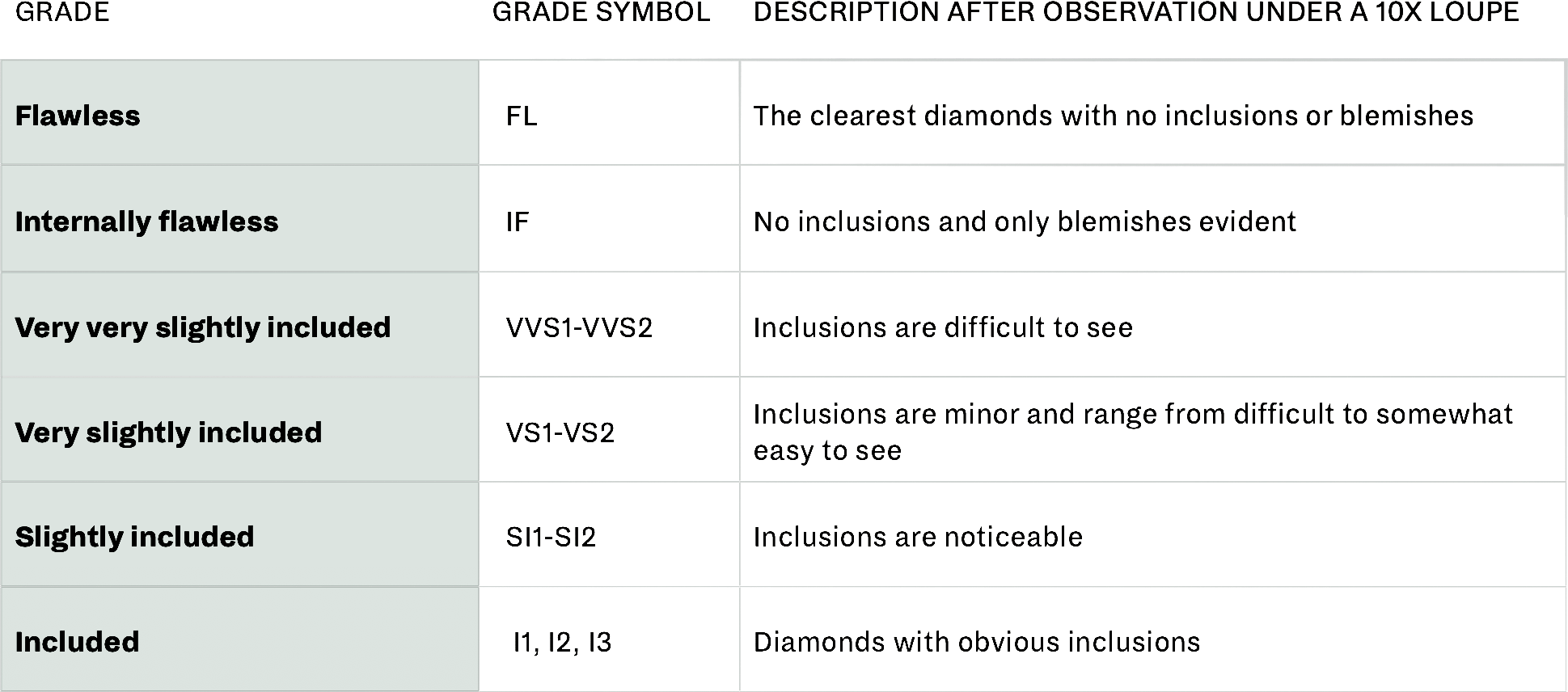

THE GIA CLARITY GRADING SYSTEM

Clarity Trends

THE TOP 5 MOST COMMON CLARITY GRADES

While SI still accounts for over half of US consumer demand, there was a move to higher clarities during 2025, continuing the trend seen in 2024. Jewellery using VS1 natural diamonds grew by 4% in 2025 on top of the 15% growth of 2024. For VS2 diamonds, unit sales grew 2% in 2025 following an 8% rise in 2024.

Data refers to market share and growth when measured by sales volume.

Inclusions – A Geological Diary

Inclusions act as tiny geological time capsules that preserve evidence of how and where a diamond formed. These trapped minerals can reveal which elements were present in the mantle at the time of growth, whether the diamond formed rapidly or slowly, and how its crystal lattice responded to millions or even billions of years of deep Earth processes. They also offer rare, direct clues about regions of the planet more than a hundred kilometres beneath the surface, far deeper than any drilling can reach.

Research in 2025 continued to deepen our understanding of how and where diamonds form. One study of inclusion-rich diamonds from South Africa found tiny metallic and carbonate minerals inside stones that crystallised between 280 and 470 kilometres below the Earth’s surface. The presence of these metals at such depths was unexpected, pointing to chemical processes in the mantle that researchers hadn’t previously recognised. Findings like these show how inclusions act as time capsules, preserving clues about parts of the Earth we can’t directly access.⁷⁻⁸

Colour

Colour

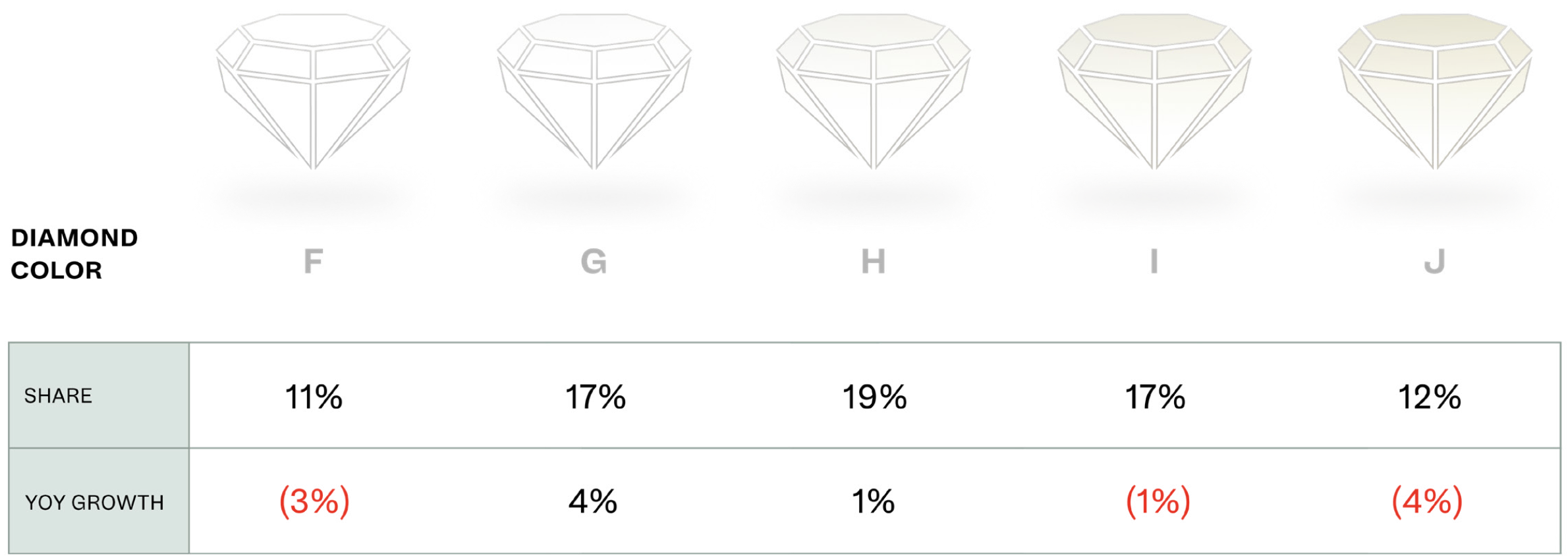

GIA COLOUR SCALE

THE TOP 5 MOST COMMON COLOR GRADES

Beyond White: Desert Ombré Diamonds

Timothee Chalamet attends the Golden Globes wearing diamond jewelry. Getty Images

Near-colourless GHI diamonds remain consumer favourites in the US, accounting for around half of demand. This trend has stayed consistent for a number of years with only small annual fluctuations. In 2025, we saw a slight move towards G and H.

That icy white dominance didn’t tell the whole story, however. The 2025 launch of De Beers Desert Ombré diamonds12 – with their warm earthy tones, ranging from cream and champagne to deep amber and whisky – sparked interest in a broader palette. Natural diamonds of every hue were out in force on the Golden Globes red carpet in January 202613, underscoring how today’s stars continue to embrace diamonds as markers of both timeless elegance and creative expression14.

Carat

Carat Weight

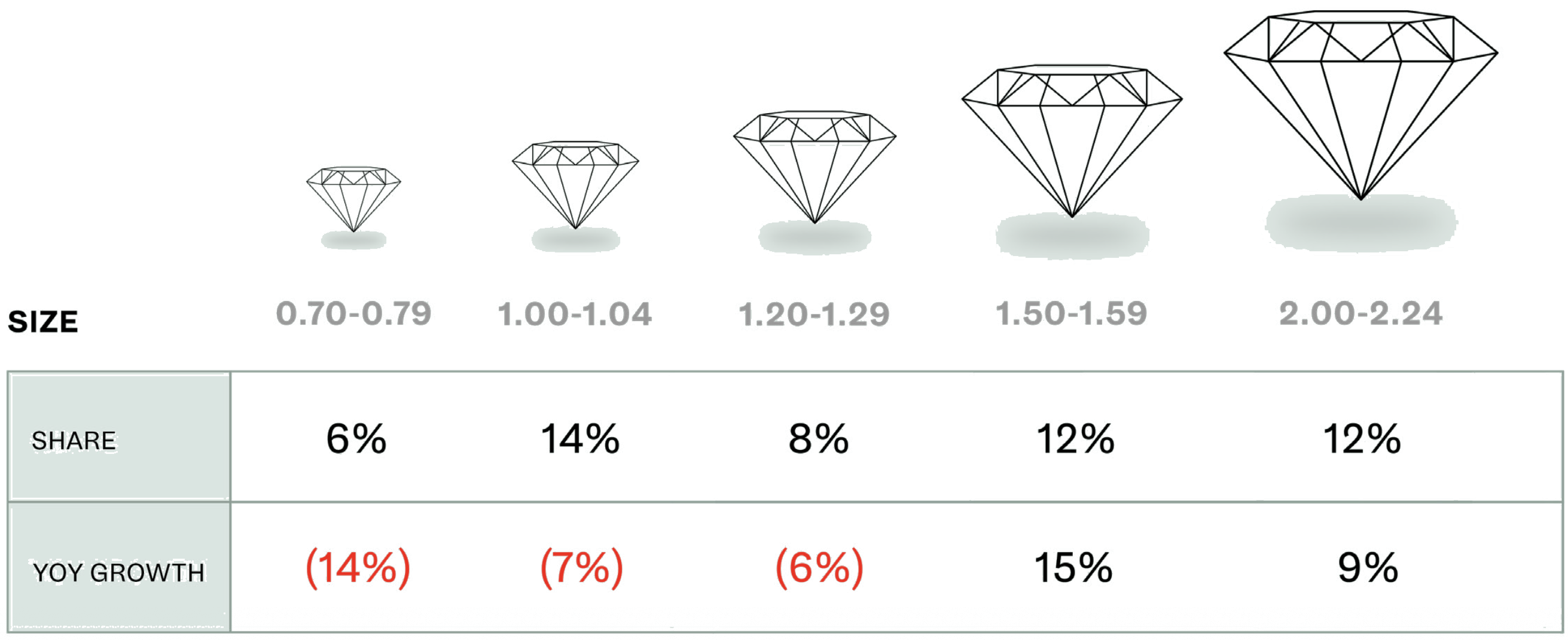

The Sweet Spot: 2–2.24 Carat Diamonds

Natural diamonds of between 2 carats and 2.24 carats continued their growth trajectory with 10% growth in 2025 on top of 18% growth in 2024 – so unit sales are up 30% over the two years. This takes the category market share to 12% and positions it only a little behind the 14% share for stones of 1 to 1.04 carats. Stones of 1.50-1.59 carats, also with a 12% category share, were the fastest growing category up 15% in 2025 on top of 9% growth in 2024, taking the two-year growth rate to 25%.

THE TOP 5 MOST POPULAR SIZE RANGES FOR CENTRE STONES

Engagement Rings

Diamond Engagement Rings

A Year of Distinctive Cuts:

Celebrity Engagement Rings of 2025

Celebrity proposals showcased a striking range of diamond cuts and deeply personal design choices, each reflecting the wearer’s individual style.

The year opened with talk of the ring marking Selena Gomez’s recent engagement to Benny Blanco—a marquise-cut natural diamond set on a yellow gold eternity band. The elongated, tapered silhouette—with its 18th-century origins and dramatic, aristocratic profile—aligns beautifully with Gomez’s distinctive aesthetic. She had reportedly envisioned this cut for years, even referencing it in her lyrics (“Good for You”, 2013), giving the design an especially personal resonance.

Later that month, Zendaya and Tom Holland marked their engagement¹² with an elongated cushion-cut natural diamond set east–west in a Georgian-style, button-back mounting. The antique-inspired silhouette blends old-world charm with Zendaya’s modern glamour.

Cristiano Ronaldo—the Portuguese footballer widely regarded as one of the greatest in history—proposed in March to Georgina Rodríguez with a central oval-cut diamond flanked by two oval side stones¹³. In May, Miley Cyrus and Maxx Morando chose an elongated cushion cut set in a bold gypsy-style yellow gold band. The east–west orientation and substantial gold setting give the classic cushion cut a free-spirited, unconventional twist that feels unmistakably “Miley,” in tune with her bohemian-leaning style.

Taylor Swift and Travis Kelce’s summer engagement¹⁴ revealed an antique elongated cushion-cut diamond on a hand-engraved yellow gold band that blends vintage romance with modern refinement. The choice feels deeply in tune with Swift’s well-known love of nostalgic, “grandma-core” aesthetics, making the ring’s old-world charm a natural fit for her personal style and the storybook tone of the proposal.

Together, these rings along with other high profile celebrity engagements of 202515, highlight a broader trend: a move toward characterful cuts, meaningful design choices and settings that blend heritage with individuality — a perfect reflection of the wider mood in diamond jewellery today.

DIAMOND ENGAGEMENT RINGS

Rounds remained the most popular shape for diamond engagement rings accounting for 62% of unit sales – the same share as in 2024. Ovals’ share of 14% was slightly down on the 16% seen in 2024. In total diamond engagement rings (including loose diamonds and semi-mounts) represented 38% of natural diamond jewellery sales in 2025.

Engagement Ring Trends

TOP SELLER DIAMOND ENGAGEMENT RINGS

Top seller Diamond engagement rings

Average Price

$7,364 (+9%)

Most popular shapes

Round 62%

Oval 14%

Average Total Carat

1.16cts (+5)

Most common clarity

SI1

Acquisition

How Consumers Are Acquiring Natural Diamonds Today

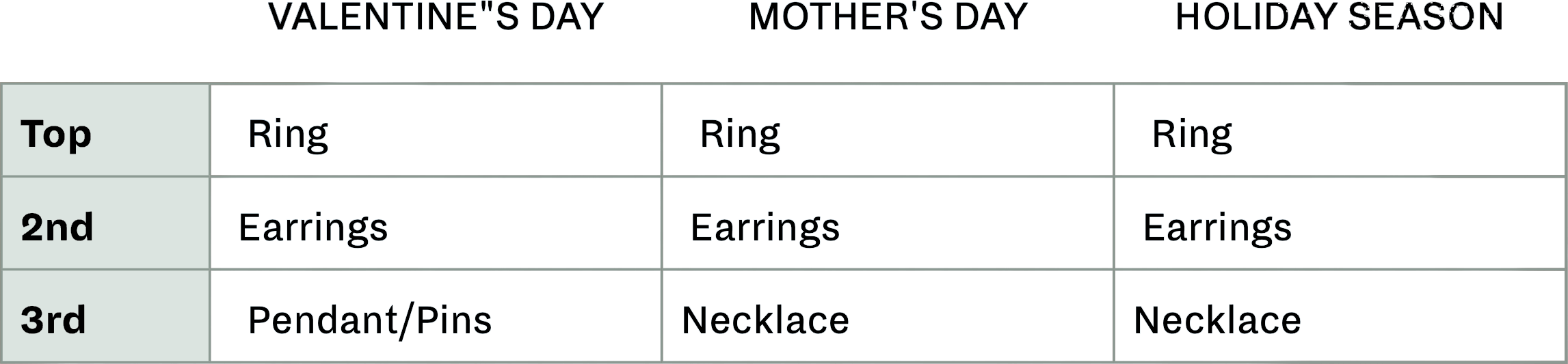

Seasonality

Even with the continued rise in women buying for themselves, an uptick in spur‑of‑the‑moment purchases, and growing male self‑purchasing, three key periods still anchor overall natural diamond demand: the end-of-year holiday season, Valentine’s Day and Mother’s Day.

November and December accounted for 30% of diamond sales in 2025. Tuesday 23 December was the strongest day for natural diamond jewellery sales, closely followed by 21, 22 and 24 December. This doesn’t mean that natural diamond sales in the period are all driven by Christmas, Chanukah or other seasonal holidays, however. December is also the most important month for engagements, according to The Knot’s survey of 17,000 couples19 – with the 25th being the most popular date for engagements. And although it’s one of the rarer birth months, around 8% of birthdays still typically fall in the last month of the year20.

Valentine’s Day and Mother’s Day remain key moments in the calendar. The month around each celebration contributed respectively 7% and 9% to annual natural diamond demand during the year.

In diamond jewelry, we see the highest demand in classic diamond studs. Sales are almost exclusively in rounds. Our customers utilize our diamond trade up program for studs, so we sell a wide variety of sizes in three different qualities.

Julie Collins

VP of Merchandising, Day’s Jewelers

Be my Valentine trends

A January 2026 survey by the National Retail Federation21 shows that 25% of US consumers plan to buy jewellery for Valentine’s Day, up from 22% in 202522. With projected spending of $7 billion, jewellery is set to be the largest Valentine’s category, contributing to a record $29 billion in total holiday spend.

Diamonds are the ultimate gift on Valentine’s Day as they embody enduring love, making them a natural choice to mark a relationship. Their versatility in both subtle everyday pieces or dramatic showstoppers means they work for every style. And with the current emphasis on personal expression and bespoke details, consumers have more ways than ever to choose a piece that reflects a shared story.

In 2025, the average total carat weight for jewellery sold in the week before Valentine’s Day was 0.59 carats, with round brilliants the favourite shape and non- bridal rings the top category. Engagement jewellery also plays a meaningful role: Valentine’s Day marks the close of the US engagement season, with 47% of couples getting engaged between November and February23

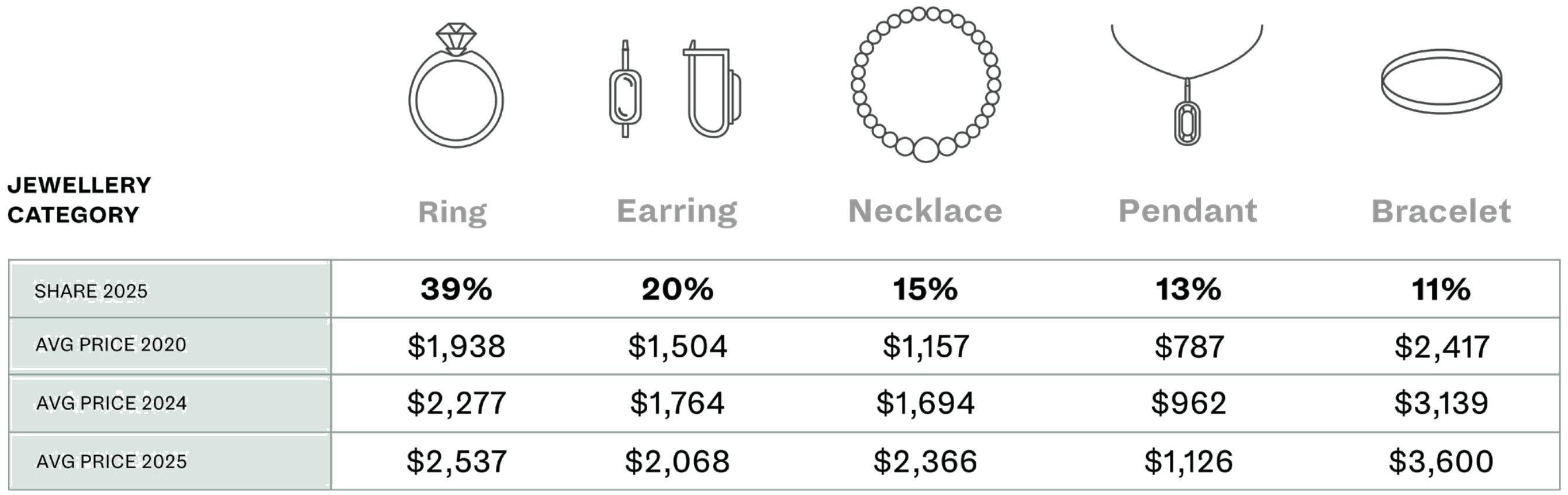

What’s hot

Tennis bracelets, wedding bands (8%) and pendants (9%) saw the biggest growth in unit sales in 2025. All categories saw significant growth in average price, reaching $2,758 across all diamond jewellery and loose diamonds.

Looking Ahead

Looking Ahead to 2026

Will Millennials continue to be the biggest cohort of diamond buyers in 2026? While many in the 30-46 bracket juggle the financial demands of family life, Generation Z looks set to remain the fastest- growing segment. Defined by the Pew Research Center as those born between 1997 and 2012, these consumers are now around 29 at the oldest while even the youngest will be adults by the end of decade. Generational patterns offer useful clues about emerging attitudes, as young adults often sit at the forefront of cultural and behavioural change. But they are broad tendencies rather than rigid categories and it’s important to avoid overstating or stereotyping how any one group buys. What is clear is that younger generations are leading the rise in individuals choosing to acquire diamonds for themselves. A 2024 consumer survey by Ipsos on behalf of De Beers24 showed that more than 40% of women’s natural diamond jewellery sales by value are self-purchase.

Men’s diamond jewellery also looks set to keep growing. Ownership still lags slightly behind women’s, but the gap is closing. With figures such as Timothée Chalamet and Colman Domingo bringing strong visibility to the category at the Golden Globes, more men are likely to purchase their first diamond in 2026.

Personality, individuality and playfulness will drive design trends over the next 12 months. Consumers are gravitating toward pieces that feel expressive and distinctive. The Pinterest Predicts 2026 report25 highlights nostalgia and self-expression as key themes, driving interest in vintage and Art Deco inspired motifs, reinvented heirloom jewellery and standout geometric forms. Reflecting this broader mood, brooches are emerging as a fresh trend, despite having been a staple for older generations and largely absent from mainstream fashion for decades. Their return on recent runways and in street style reflects a larger appetite for standout, expressive pieces. This could also see people moving away from diamond size for size’s sake in search of pieces with rarity, stories and individuality26 . Stacked jewellery may also continue its rise, with layered rings and bracelets offering a versatile way to build a personalised look. Natural diamond engagement rings are increasingly mixing classic and contemporary elements, as seen in those worn by Zendaya, Taylor Swift and Miley Cyrus in 2025. And in the spirit of the Year of the Horse, we may see a surge in interest for equestrian-inspired inspired diamond designs.

It is clear that consumers still strongly desire the timeless beauty and versatility of natural diamonds. A 2025 Ipsos/De Beers survey on 18–74 year-olds27 found that more than 40% of women and 50% of men anticipated that they would purchase or receive natural diamond jewellery in the next two years (including 23% of women and 29% of men acquiring jewellery for themselves). Over one in five women thought they would very likely purchase or receive diamond jewellery in the next 12 months, with higher figures for Generation Z, Millennials and women who already own several pieces of natural diamond jewellery. There is a huge amount to be positive about for the year ahead and 2026 is shaping up to be a year of bigger, brighter, more glamorous jewellery.

Pinterest Predicts 2026 points to a growing appetite for personal expression through nostalgia, and we’re seeing that show up strongly in jewellery. In our ‘Brooched’ trend, men are embracing heirloom brooches and vintage pins as modern style signatures, rewearing and reinventing pieces with personal meaning. At the same time, ‘Neo Deco’ taps into renewed love for Art Deco–inspired geometry and bold, graphic forms, helping people build looks that feel both timeless and distinctly their own. We’re also seeing nature-led motifs gain momentum through ‘Wilderkind,’ inspiring playful details and unexpected statement pieces. Together, these trends signal a confident return to individuality – with heritage cues reimagined for today.

Caroline Orange-Northey,

Managing Director, UK & Ireland at Pinterest

Stackable diamond pendants and diamond earrings. Credit: Natural Diamond Council

Stackable diamond rings.

Credit: Natural Diamond Council

Download This Report

Natural Diamond Council’s Diamond Report series covers trends, origin, and other particularities of the ultimate gemstone – natural diamonds. Created in collaboration with governments, communities, and experts, these reports empower consumers, media, and industry professionals with transparent insights and engaging facts.

Many thanks to the following contributors:

Jackie Steinitz

Edahn Golan and Tenoris

De Beers Group

Day’s Jewelers

Sotheby’s

Pinterest

SOURCES

1. https://www.gold.org/goldhub/data/gold-prices

2. https://sewelomag.com/the-top-jewelry-auction-results-2025/

3. https://www.naturaldiamonds.com/diamond-reports-natural-diamond-trends/

4. https://www.naturaldiamonds.com/diamond-engagement-rings/4cs-of-diamonds/

5. https://www.tenoris.bi/

6. https://business.pinterest.com/en-gb/pdf/pinterest-predicts/2026-trend-report/

7. https://www.naturaldiamonds.com/engagement-rings/round-brilliant-cut/

8. https://www.igi.org/what-makes-the-round-brilliant-diamond-cut-so-popular/

9. https://4cs.gia.edu/en-us/blog/how-to-select-round-diamond-engagement-ring/

10. https://www.scientificamerican.com/article/almost-impossible-deep-earth-diamonds-confirm-how-these-gems-form/

11. https://communities.springernature.com/posts/diamonds-as-witnesses-of-deep-earth-chemistry-the-surprising-coexistence-of-metallic-and-carbonate-inclusions

12. https://adiamondisforever.com/style-culture/what-are-desert-diamonds-discover-how-theyre-formed-and-what-makes-them-unique/

13. https://www.naturaldiamonds.com/culture-and-style/golden-globes-2026/

14. https://adiamondisforever.com/style-culture/golden-globes-2026-red-carpet-desert-diamonds-done-right/

15. https://www.naturaldiamonds.com/engagement-rings/zendaya-engagement-ring/

16. https://www.naturaldiamonds.com/engagement-rings/celebrity-engagement-ring-2025/

17. https://www.naturaldiamonds.com/engagement-rings/taylor-swift-engaged/

18. https://www.naturaldiamonds.com/engagement-rings/celebrity-engagement-ring-2025/

19. https://www.theknot.com/content/wedding-data-insights/real-weddings-study

20. https://ourworldindata.org/grapher/births-per-month-annual

21. https://nrf.com/media-center/press-releases/valentine-s-day-spending-expected-to-reach-new-records

22. https://nrf.com/media-center/press-releases/nrf-survey-valentine-s-day-spending-reaches-record-27-5-billion

23. https://www.theknot.com/content/things-to-know-for-proposal-season

24. De Beers commissioned US Diamond Acquisition Study 2024 conducted by Ipsos

25. https://business.pinterest.com/en-gb/pdf/pinterest-predicts/2026-trend-report/

26. https://www.elle.com.au/fashion/wedding/engagement-ring-trends-2026/

27. De Beers commissioned US Natural Diamond Tracker Study, 2025 conducted by Ipsos