From Investment To Sentiment: The True Beauty Of Natural Diamonds

As the diamond industry evolves with the emergence of alternates, Russell Mehta explores why natural diamonds continue to hold enduring value—not just as a financial asset, but as emotional, cultural, and generational heirlooms.

Over the past four decades, the way consumers engage with the process of buying diamonds has evolved, which reflects the evolution of the retail and luxury industry. In the early 1980s, the purchase of a diamond was a personal experience, filled with emotion and symbolism, shared with family and saved for special occasions. The allure of a diamond came from its rarity, its value and longevity. It was a conversation starter, a head-turner, so to speak.

Today, when attention spans are shorter and time is of a greater essence, some of that romanticism has been replaced by a more pragmatic practice. Certification, transparency, and access to online platforms allows consumers to evaluate diamonds like any other commodity. Shoppers compare prices, discuss flaws, and often make their decisions before they have even walked into a store—if at all they visit one. The experience is transactional rather than emotional.

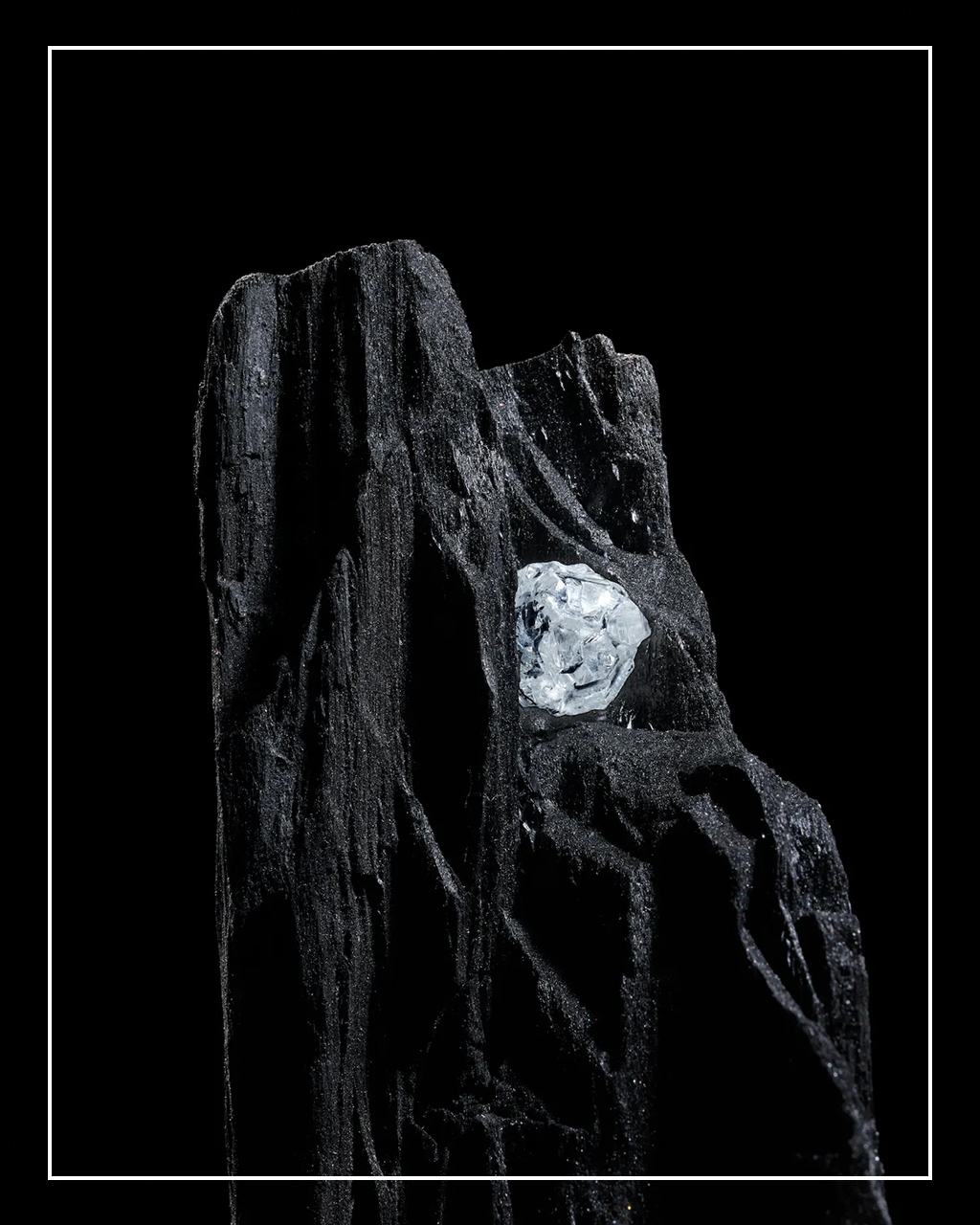

Image: Rosy Blue

This shift has also led to debate around the value of diamonds as investments. Often compared to gold or art, diamonds are frequently misunderstood financial instruments. Unlike luxury handbags or market-traded assets, diamonds derive their worth from more than just resale value. They hold emotional, familial, and cultural significance. For instance, I own a diamond passed down from my grandfather. Its importance cannot be measured in just monetary terms.

Lab-grown diamonds have brought in a new element into this conversation. Created in controlled environments using technology, these are physically and chemically identical to natural diamonds—but they lack rarity and emotional heft. They are more of industrial products rather than enduring heirlooms. Moore’s Law explains it best—as technology evolves, production becomes cheaper, quality improves, and sizes get larger—further reinforcing lab diamonds’ status as a manufactured commodity, rather than a unique and naturally-available gem.

The growth of lab-grown options has, however, accelerated the commoditization of diamonds, particularly among younger, cost-conscious consumers. A young, first-time buyer getting a foothold in his/her career might opt for a lab-grown diamond for an engagement ring, preferring affordability over tradition. But by the time he/she gets to a 10th anniversary or other milestones, far steadier in career, he/she many turn to natural diamonds for their timelessness and emotional resonance.

Diamonds aren’t as easily liquidated as gold, nor are they as difficult to trade as fine art, occupying a unique middle ground. Their intrinsic value tends to hold over time. For example, only a few of my art pieces have gained value over the past two decades. But I treasure each one—not because of their price, but because of the memories tied to acquiring them. Diamonds offer that same duality: sentimental worth and potential financial security, particularly in uncertain times.

While market prices do fluctuate, diamonds are quite resilient over a long term. They don’t depreciate rapidly, also because they are not easily damaged not do they lose their lustre. A Bain & Company report confirms that over the past 35 years, diamond prices have risen by an average of 3% year on year.

Supply dynamics also support the long-term value of diamonds. There has been no major, new natural diamond reserve discovered in over two decades. Added to that, existing mines are steadily running out. For example, the Argyle mine in Australia, which produced some of the world’s most stunning pink diamonds for over 30 years shut down in 2000. Since the closure of one of the largest producers of diamonds, those rare and highly coveted stones have become sought-after collector’s items.

Following record highs of 2021 and 2022, the diamond industry has experienced a correction. Global retail sales of diamond-studded jewellery have fallen from $90 billion to roughly $75 billion in 2024. This drop is partly attributed to slowing luxury demand in key markets like China and growing interest in lab-grown alternatives in the U.S. Despite these challenges, natural diamonds continue to represent emotional permanence in an increasingly fast-paced, disposable world.

At its heart, the diamond industry is not just about the commerce—it’s about commemorating life’s defining moments. Diamonds mark engagements, weddings, anniversaries, and birthdays in their own unique way. They aren’t just products; they’re tangible reminders of love and connection, memories and sentiments.

Unlike any other commodity, natural diamonds are a brand of their own: one built on emotion, rarity, and legacy.

For today’s consumers, my advice is simple: stay emotionally invested in the long term. Choose natural diamonds, not just as adornments, but as lasting symbols of love. Because some things—like the memories they represent—truly are forever.