Diamonds – The Myth, the Magic and the Everlasting Allure

Aside from the illusory beauty and emotional quality of natural diamonds,

there is more to picking the it piece that will give you long term value.

Here’s how to identify and buy an investment diamond when you see one

In a world where trends come and go, natural diamonds remain an eternal symbol of allure, luxury, and enduring value. Their journey from deep within the Earth’s core to the sparkling gem we admire today is a testament to their rarity and uniqueness, setting them apart from any other gemstone. But beyond their aesthetic charm, natural diamonds have consistently proven themselves as a solid investment. Their limited supply and ever-growing demand have historically led to appreciation in value over time. As economic landscapes shift and uncertainties loom, diamonds have offered stability and acted as a valuable hedge against inflation, reassuring investors of their reliability.

Yet, it’s not just their economical sense that draws people in. Diamonds carry immense sentimental value, capturing and immortalising cherished moments. Why we choose a diamond to signify love in a relationship (as an engagement ring), a coming-of-age (as a birthday present), or to mark our milestone moments (winning the chair at the corner office), is a symbolic representation of the value we place in our lives and the consequent position of a beautiful piece of natural diamond within it. Diamonds then become heirlooms, passed down through generations, each carrying the stories of love and commitment.

Designers who have long worked with the stone recognise its value within the wearer’s life. Creators such as Pratik Shah of Estaa Gems and Natasha Khurana of The Line know that when it comes to jewellery, natural diamonds always form the canvas for great craftsmanship – a quality that buyers always appreciate and recognise. “At Estaa, we choose only natural diamonds, considering their rarity as part of the intrinsic value in our pieces,” explains Pratik Shah, chairman and managing director at Estaa Gems. “We often see a natural diamond’s history, story, and value converge in our creations. For example, in one of our signature sets featuring a 18 kt gold necklace and earrings with black nanoceramic plating, we’ve employed all the different cuts of natural diamonds. The brilliant cuts represent the pinnacle of modern diamond technology and elegance, while the rose cuts reflect a historical connection to the past, and the uncut diamonds symbolise the raw, natural beauty of the stone,” he explains. This combination exemplifies how the history, story, and value of natural diamonds can be brought together into a single piece, crafting jewellery that’s not only visually stunning but rich in meaning and tradition.

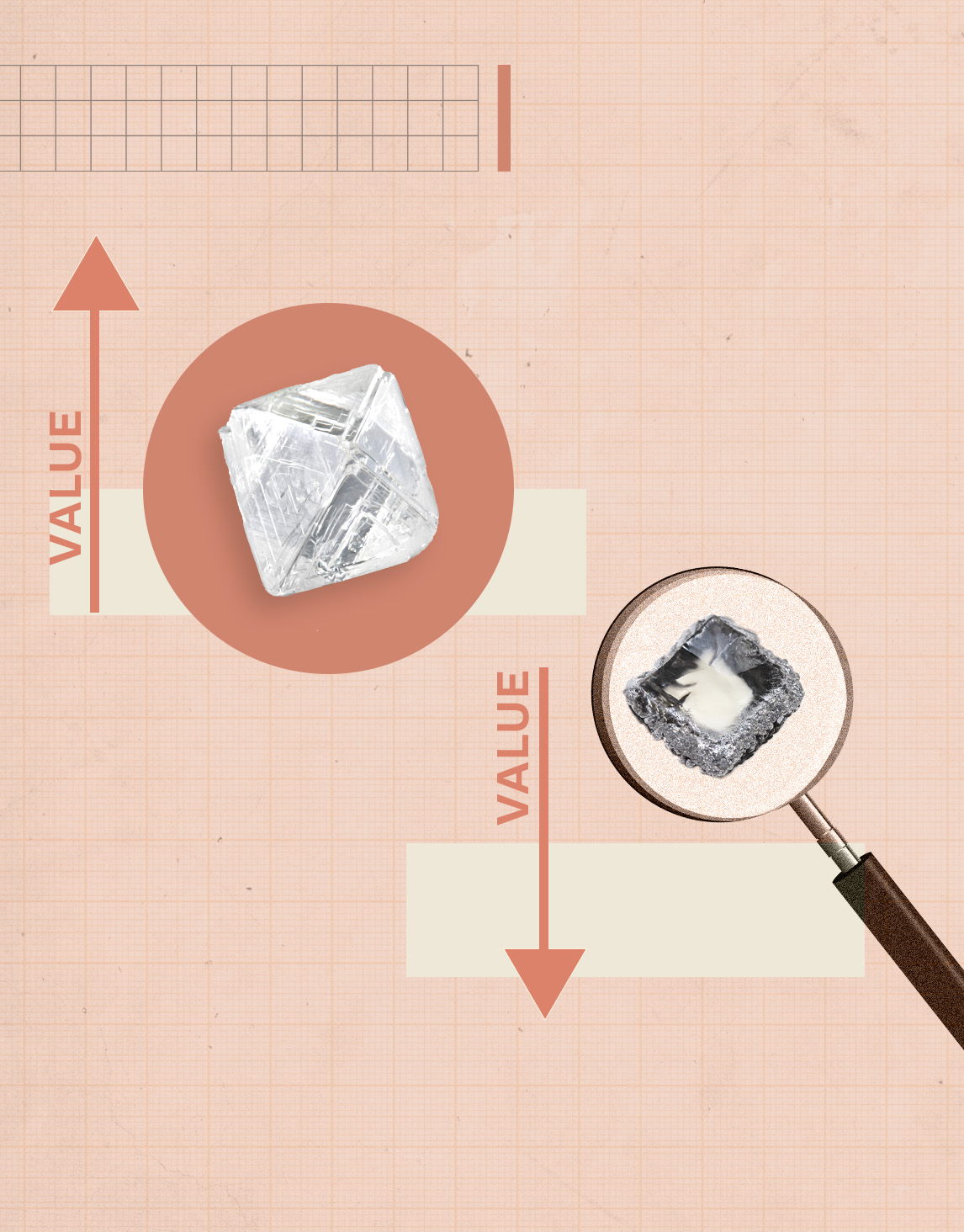

The Distinction Between Natural and Laboratory-Grown Diamonds

A comprehensive report called Diamond Facts compares the differences between laboratory-grown diamonds and natural diamonds – how their values distinctly differ as well as the misconceptions that surround them both. According to a Bain & Company estimate, over a 10-year period (2008 to 2018), the average production cost of a high-quality laboratory-grown 1 carat stone fell by 90%. When laboratory-grown diamonds began appearing in commercial quantities in the jewellery market around 8 years ago, prices were typically slightly cheaper than those of natural diamonds. However, as the laboratory-grown market has expanded, the relationship has diverged. For example, analyst Paul Zimnisky notes that in 2016, a round, almost colourless, high quality, 1 carat synthetic stone cost around 10% less than a natural diamond. However by the close of 2022, the differential was as much as 80%, depending on the manufacturer. Ziminisky also illustrates that K, citing that the price of a 1.5 carat stone has fallen by over 74%.

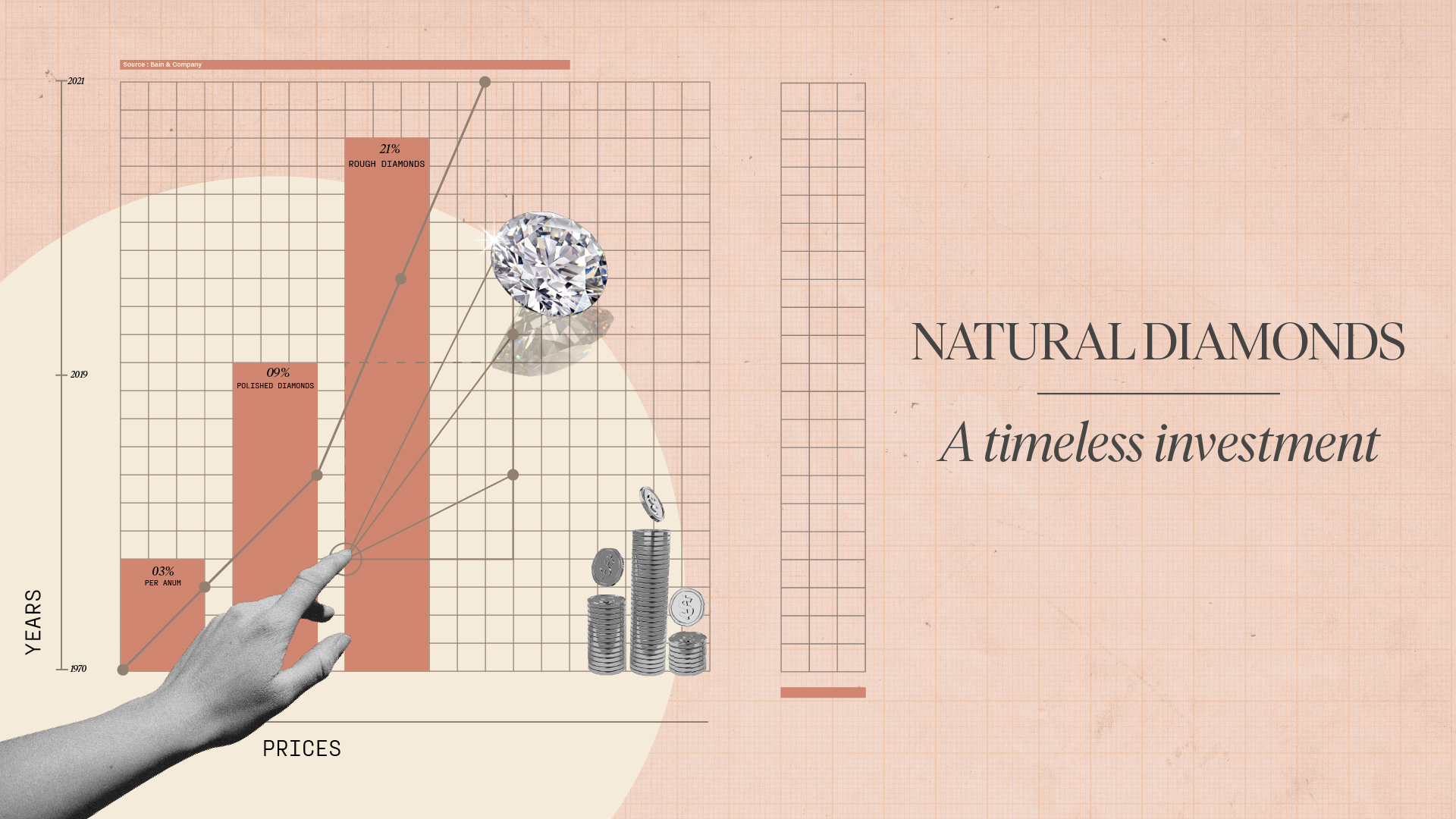

The value of a natural diamond on the other hand, has seen an increase of 3% YOY over the last 3 decades, as shared by Bain & Company, only further proving the investment value of the earth’s naturally-found stone. They also noted that in 2021, rough natural diamond prices grew by 21% and that prices increased by 9% year on year for polished diamonds. More proof lies in the shine.

The main distinction lies in the origin and rarity of these diamonds. Natural diamonds are formed over billions of years and propelled to the surface through violent volcanic eruptions. This formation process under intense heat and pressure leads to the creation of unique structural patterns which means every natural diamond is one-of-a-kind. They are also a finite resource as there are only limited places and viable mines where natural diamonds can be found. Laboratory-grown diamonds, on the other hand, are usually mass produced in a factory, making them unlimited and identical. Natural diamonds can also boast an inherent value and emotional significance that laboratory-grown diamonds can’t replicate. This exclusivity makes natural diamonds a better investment, as their limited supply and increasing demand historically lead to value appreciation.

Natural Diamonds:

An Irreplaceable Investment Choice

“Natural diamonds remain a solid investment because they hold intrinsic value. And the best marker of that is their resale value, which we know isn’t the case for alternatives,” explains designer Natasha Khurana behind jewellery label The Line. Evidence of this can be found in vintage jewellery auctions, where even items from less-renowned individuals garner significant interest and value. Moreover, to verify the price of a natural diamond is a more achievable and accessible feat. The diamond industry follows strong standardisation, with well-recognised bodies that provide certification on their colour, cut, clarity and make. Each of these characteristics corresponds to a certain value on something called the Rapaport price index. Whiter cuts, spotless clarities and certain cuts like brilliant-cut are valued higher. Anything upwards of a 30 cent diamond, can be bought with a certificate, and some of the most reliable certification bodies are IGI, GIA and HRD. It is worthwhile to note that while these certification bodies aren’t reserved only for natural diamonds, the added layer of certification that the natural diamond industry offers are the ethically-sourced certifications from regulatory bodies such as the Kimberley Process mandated by the United Nations and the World Trade Organization that ensure conflict-free natural diamonds.

So, while lab-grown diamonds have their place, the timeless allure and enduring beauty of natural diamonds make them an irreplaceable investment choice. As Khurana aptly says, “All that is wondrous about the natural world — animals and humans, sunsets and sunrises, oceans and glaciers, mountains and valleys — I think natural gems are kind of a tangible summation of that wonder. It’s like holding a piece of all the forces of the natural world. How you place value on that — beyond industry standards — that really depends on your own value systems.”